The upcoming UK’s Sustainability Disclosure Requirements (SDR) will be a key development in 2023. Find out what the SDR will entail, the affected stakeholders and requirements in the UK’s ESG reporting landscape.

As the world ramps up its focus on sustainability disclosure and risk management, the UK’s ESG regulatory regime is no exception to this trend. In recent years, proposals as well as new statutory instruments and regulatory requirements that are currently underway reflect the need to strengthen disclosure and promote the management of climate-related financial risk and opportunities across the British economy, particularly for financial institutions and asset managers. This is also in light of heightened concern that companies resort to misleading or unsubstantiated sustainability-related claims about their products, or ‘greenwashing’. Given the need to protect consumers as they navigate an increasingly complex investment landscape and strengthen trust, the UK’s Financial Conduct Authority (FCA) had recently issued a consultation paper (“CP 22/20”) on its proposed regime of the Sustainability Disclosure Requirements (SDR). The upcoming SDRs are intended to create an integrated and streamlined framework for corporates and financial institutions to comply with all sustainability-related reporting requirements.

Following the UK Government’s Roadmap to Sustainable Investing published in October 2021, the FCA’s CP 22/20 builds on responses to the discussion paper on sustainability disclosure requirements and investment labels which is critical in advancing the FCA’s anti-greenwashing initiatives. With increased scrutiny from investors and a demand for wider sustainability-related measures to be considered, the proposal is aimed at increasing transparency regarding the sustainability of investment products and facilitating like-for-like comparisons, particularly for retail investors.

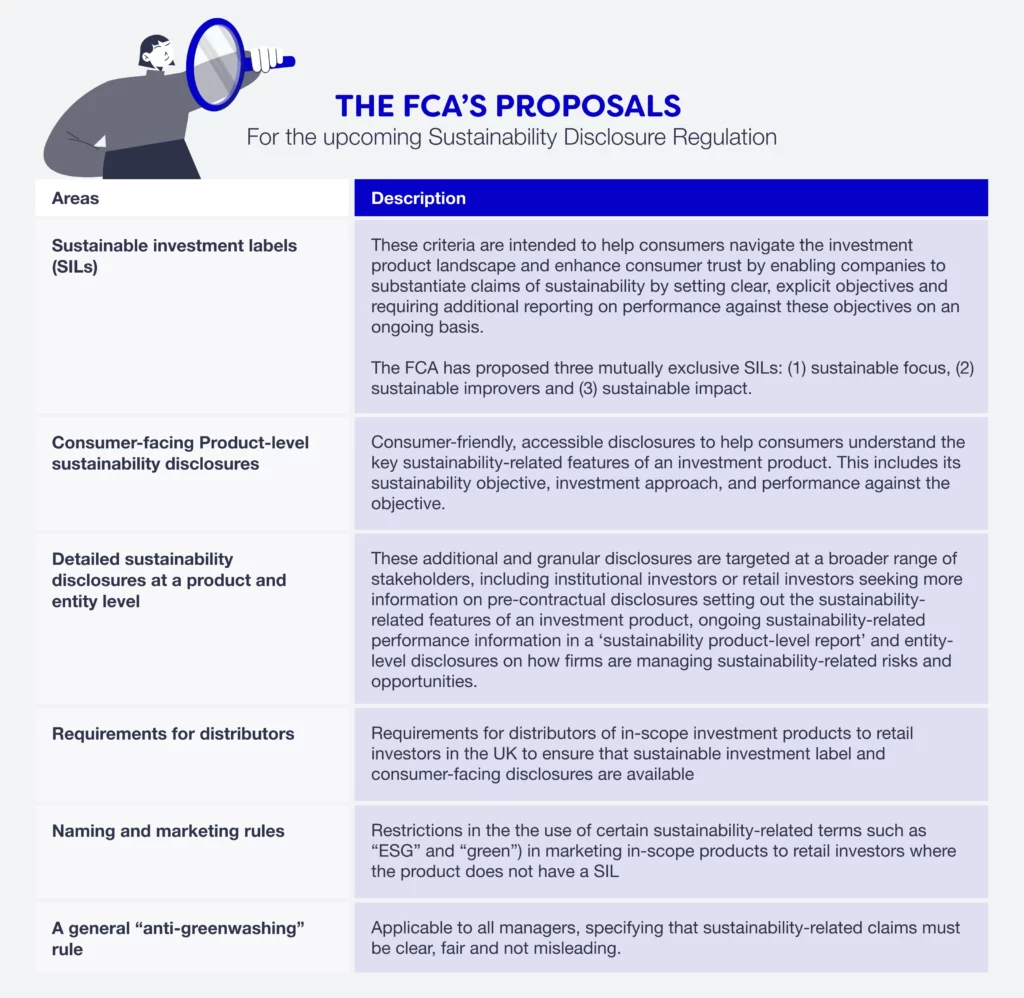

The proposals outlined by the FCA in the consultation paper introduce a range of measures and modifications which include sustainable investment labels, disclosure requirements and restrictions on the use of sustainability-related terms in product naming and marketing with the objective of clamping down on greenwashing.

Among some of the key proposals of the SDR is the introduction of sustainable investment labels (SIL) designed to facilitate the provision of accurate information for investors on how the funds impact social or environmental sustainability, and how this is measured and reported. Under SDR, financial products will be labeled based on intentionality and their actual contribution to positive sustainable outcomes. If a product does not meet the criteria for a label, certain restrictions apply regarding the use of sustainability-related language; and its marketing may not include words such as ‘sustainability’, ‘responsible’, ‘green’ and much more.

What will the SDR mean for companies in the UK?

While some requirements are expected to be implemented via a phased approach, others are likely to be enforced soon. The SDRs are currently in the midst of legislative approval and feedback from stakeholders. The current proposals apply to certain FCA-regulated firms and the rules are expected to be finalized by the end of Q2 2023, with disclosure rules applying from 2024 and reporting commencing in 2025. Firms that manage investment products for retail investors and their products are expected to be subject to the product labeling and disclosure rules which include wealth, fund and asset managers.

How can firms be better prepared?

In light of the upcoming requirements, it is critical for firms to embark on concrete steps to understand the nature of their products in the context of the SDR and determine which disclosure requirements their investment products would be eventually subject to. To ensure appropriate labelling of investment products, conducting a detailed scoping and product classification exercise to determine the extent of alignment with the proposed labels is essential.

For existing products tied to sustainability objectives, these objectives should be specific and measurable. In addition, when investment policy and strategy are aligned to sustainability outcomes, the disclosures should be adequately explained in terms of how the outcomes are measured and the appropriate key performance indicators (KPIs) that are linked to the disclosure. Given the evolving nature of ESG regimes, the asset management industry, particularly those with asset management businesses on a global scale will have to be cognizant on how the upcoming SDR regulation will align with global frameworks and ESG regimes outside the UK.

In essence, while the SDRs provide asset owners with critical insight into the environmental and social impacts of companies in their portfolios, it also means that they would have to be adequately prepared for changes in the landscape and their exposure to increased regulatory risk as a result of misleading representations on the sustainability-related features of investment products or services. The more an entity associates itself with sustainability, the more it will run the risk of exposing itself to regulatory investigations and even litigation. It is thus critical for companies to regularly review their sustainability communications and marketing materials to ensure compliance with the anti-greenwashing rule.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.