Good ESG reporting can give companies a competitive edge in their industries. Find out how your company can benefit from a well-written ESG report.

Good ESG reporting is indeed a competitive advantage if done right. Sharing how well your company engages in good environmental, social and governance practices not only improves transparency on the various risks, opportunities and challenges your company faces, but also assures stakeholders of your company’s operations and values.

Here are five key benefits of publishing a well-written ESG report:

- Strengthen brand perception

As brand perception heavily depends on a company’s relationship with its stakeholders, effective and open dialogue is key. Many companies are disclosing their ESG commitments, backing their claims with measurable data on their actions, to align their brand with good ESG practices. ESG reporting allows companies to publicly share their business activities in relation to ESG, which can positively affect how people view them. With measurable data to track your ESG performance, ESG reporting can set you apart from competitors, boost your company’s image as a responsible and meaningful brand, and appeal to stakeholder interests in the long run. - Attract consumers

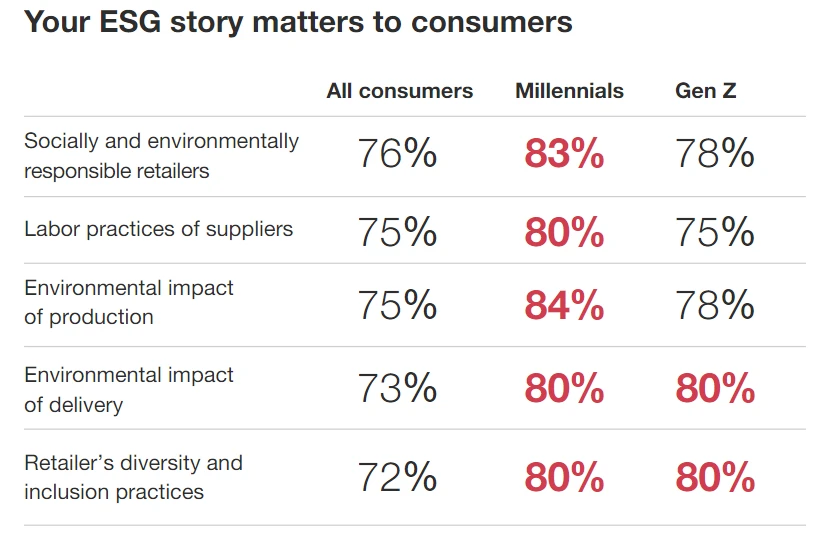

With the growing trend of green consumerism, publishing an ESG report can attract more consumers. A recent survey highlights that 70% of consumers care about the impact brands are having on environmental and social issues, and 46% pay attention to these efforts before purchasing and supporting a brand’s products. In particular, young consumers are more dedicated to sustainability, with 83% of millennials and 78% of Gen Z-ers looking for businesses that are socially and ecologically conscious (below).

Source: PwC (2021) - Enhance employee engagement

ESG concerns are important to the current talent pool, both personally and professionally. In order to attract and retain employees, companies must be aware of ESG issues and be proactive in developing programs and practices that appeal to their employees. Focusing on sustainability and ethical business practices creates a sense of purpose and meaning for their employees, which boosts motivation and nurtures a stronger sense of loyalty. Satisfied and enthusiastic employees are also more productive and yield better results. Communicating practices and values through publishing an ESG report can help to attract potential employees and maintain a robust talent pipeline. - Attract investors

Over the years, ESG investing has become more mainstream. Despite major disruptions, such as the Covid-19 pandemic, investments flowing into companies with good ESG performance continue to grow.

In 2020, Larry Fink, CEO of BlackRock, the world’s largest asset management firm, wrote in his CEO letter, “Our investment conviction is that sustainability- and climate-integrated portfolios can provide better risk-adjusted returns to investors. And with the impact of sustainability on investment returns increasing, we believe that sustainable investing is the strongest foundation for client portfolios going forward.” Investors believe that companies that take sustainability and climate concerns into consideration generate a better risk and return profile.

Having a clear ESG strategy and demonstrating consistency in reporting are important factors in investors’ decision-making process. Companies that do not issue ESG reports risk missing out, as hesitant investors could pass them up, and may even lose existing investors. - Stay ahead of the curve in a fast-changing regulatory landscape

Governments around the world are tightening their regulations and implementing laws to penalize companies that do not comply with ESG regulations. Many stock exchanges – including in the EU, Singapore, Indonesia, India and Hong Kong – are mandating sustainability reporting for listed companies in loan, investment and insurance activities.

Governments also require transparency in supply chain operations. The EU’s Circular Economy Action Plan requires company disclosures on supply chain activities. According to Harvard Business Review, multinational corporations are increasingly pledging to partner only with suppliers that meet social and environmental standards. More MNCs are placing greater emphasis on having a sustainable supply chain of suppliers and distributors and are conducting audits to ensure their entire value chain.

In sum, reporting on your company’s ESG performance positions you strategically to reap the benefits of a range of competitive advantages.

Want to know more about how you can practice good ESG Reporting?

Read our previous post on ‘5 Best Practices for ESG Reporting’.

Simplify Your Sustainability Performance & Tracking With myCSO

✅ Calculate your scope 1, 2 and 3 emissions instantly

✅ Gauge your company’s sustainability performance

✅ View your sustainability performance all from one dashboard

✅ Benchmark against industry peers

Enter your information below to book a demo with our team today.